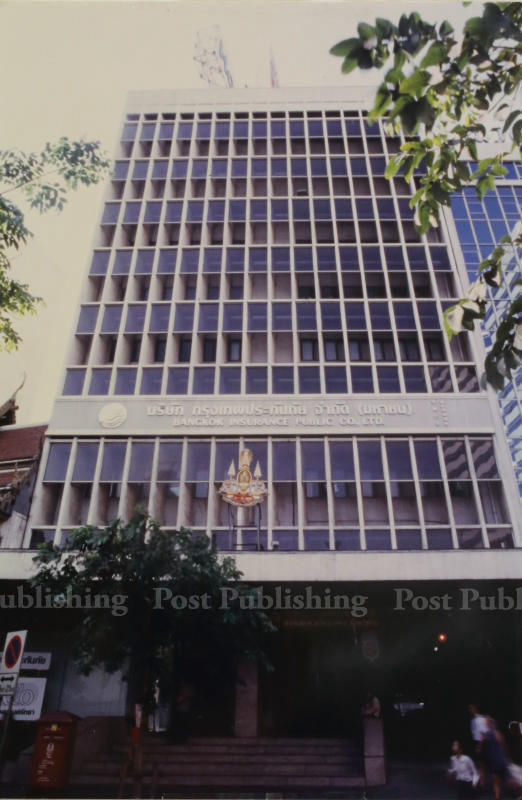

BKI’s growth has skyrocketed from 26 million to 16 billion baht in premiums thanks to customer-centric vision and openness to change

- By Chatchai Thanachindalert -

Bangkok Insurance Plc (BKI) has become one of the most recognisable brands in the Thai insurance sector.

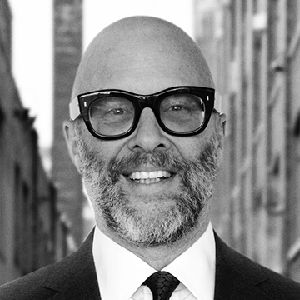

Looking back on its growth, Chai Sophonpanich, executive and adviser to BKI and chairman of Bangkok Insurance Foundation, attributed the company’s successes to a mix of “changed and unchanged strategies”.

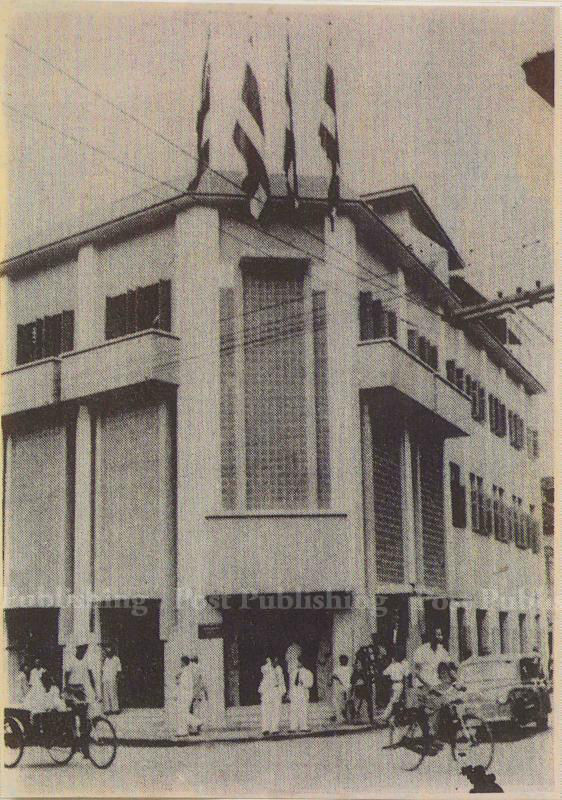

In its early days, BKI wrote only 26 million baht in premiums. That number has now soared to 16 billion baht, proof that business is booming.

Yet, the company has managed to maintain its original philosophy which was laid out by company founder Chin Sophonpanich which is to treat customers and employees as “benefactors”.

The only changes seen have been in certain policies and business plans which had to be done to keep the company abreast with emerging trends and demands in the insurance industry. The firm has to continuously figure out how to best meet demands to overcome challenges.

All of BKI’s strategies are centred on exceeding expectations of customers.

The company has made it a priority to do its best to serve customers, said Mr Chai, who is now 76.

However, there has been one major change since the company’s founding in 1947 its focus on core insurance services. BKI, in the eyes of Mr Chai, has gone through a tremendous change, especially in its customer base, from when he joined the firm on his first day at the age of 26.

Many motorists hail BKI as one of the best car insurance companies in Thailand. In the past, the company was better known solely as a provider of fire insurance.

“We need to move in tandem with changes in economic conditions,” Mr Chai said, noting that 60% of the company’s business now involves car insurance.

The company’s workforce has also grown. In 1968, there were only 70 BKI staff members. Now the headcount is pushing 1,500.

The employees are more versatile, too. Previously, employees specialised in a specific insurance field but now they must possess knowledge of all types of insurance, from fire and verhicle to sea transport protection.

Chai Sophonpanich

This well-rounded capability has been a prime reason that BKI has drawn in new and retained old customers. Insurance policies can now be processed quickly via a single employee, Mr Chai said.

“We want to build impressive services with high-quality employees,” he added.

The company never stops learning from experience which is often brought on by downturns in the economy.

Some of the worst periods experienced by the company came from the Tom Yum Goong financial meltdown of 1997 and the flooding crisis of 2011. Both crises put BKI’s resilience to the test and the company emerged stronger as it learned how to solve problems and sustain its business, Mr Chai said. Even the Boxing Day tsunami disaster which struck key tourist provinces in the Andaman Sea in 2004 was a good lesson as the company’s work directly involves risks and damages.

Mr Chai said the BKI needs to stay alert to uncertainties in the future and keep up with the rapid changes in technologies.

Devising a long-term plan may not be enough in today’s society, he said. BKI needs to be quick to adapt itself while at the sometime remaining flexible in its response to changes in the future at the same time.

It is this aptness to make adjustments which propels BKI forward to satisfy

customers.

Tag

Tag

Tag

Tag

Tag

Tag

SHARE THIS PAGE!