From Chinatown to fintech, surviving transience has become a casual habit

- By Somruedi Banchongduang -

Throughout its 74 years in business, Bangkok Bank has managed to ride out many economic storms. Today it faces the new challenge of digital disruption.

There are three major factors stimulating changes in consumer behaviour and business environment, namely regionalisation, urbanisation and digitisation.

Regionalisation has resulted in rapid growth in trade, investment and travel within the Asean Economic Community (AEC) and nearby countries, said president Chartsiri Sophonpanich.

This has opened up opportunities for investors interested in expanding their investment base.

Thailand is experiencing urban growth all across the country, Mr Chartsiri said, and this has stimulated consumer demand for convenient, fast and secure financial transactions, along with assistance to achieve future financial stability.

Drastic changes are taking place in virtually all business sectors due to digital disruption. These include finance and banking, as cash is being replaced by electronic transactions that can be made conveniently, safely and quickly, anywhere, any time.

Over the past three years, the popularity of digital banking has been rising rapidly, including the number of user accounts, transaction volume and transaction value, Mr Chartsiri said.

According to Bank of Thailand statistics, fund transfers using internet or mobile banking services were up 168% year-on-year at the end of December 2017.

To meet changing customer needs, Bangkok Bank has prepared a full range of digital banking services, enhanced its IT system to support the development of new products and services, improved its internal working systems and trained staff to lead customers into the new era of banking.

The emergence of fintech startups is another significant change factor, as startups play a key role in creating innovative products and services for the financial industry.

Bangkok Bank does not see fintech companies as competitors, but rather as new players who will help open up new markets, such as using electronic transfers for transactions instead of cash.

InnoHub, the first global fintech accelerator programme in Thailand, was launched by Bangkok Bank in 2017. The bank selected eight startups out of 119 from five countries to join the programme, which is aimed at introducing innovative technologies to Thai and regional markets.

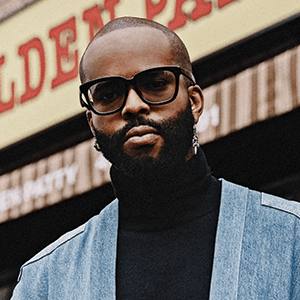

Chartsiri Sophonpanich

The bank is continuing to work with several of these companies to explore the development of new services for customers, and one of them, FundRadars, has worked with a subsidiary, BBL Asset Management, to offer a mobile app for investors to track market information and analysis.

Bangkok Bank began its business operations on December 1, 1944. From a small Thai bank in a two-story shophouse in the Ratchawong area of Bangkok’s Chinatown, Bangkok Bank has grown to become one of Southeast Asia’s largest regional banks, with total assets of more than three trillion baht, and enjoys the country’s largest customer base, with more than 17 million accounts.

The bank’s international network is the largest of all Thai banks, with a presence in Cambodia, the Cayman Islands, China, Hong Kong, Indonesia, Japan, Laos, Malaysia, Myanmar, the Philippines, Singapore, Taiwan, Britain, the US and Vietnam.

Tag

Tag

Tag

Tag

Tag

Tag

SHARE THIS PAGE!