Deves Insurance has enough lighthouses in place to ensure neither it nor its customers are ever at risk, says its MD

- By Chatchai Thanachindalert -

Seventy two years in the insurance business have given Deves Insurance Plc both the sweet taste of success and the bitter bite of pain.

Looking at the road ahead, Deves’ managing director Chartchai Chinvetkitvanit, believes the state-owned company will consolidate its foothold and stand tall among privately-owned insurance firms

His firm officially opened its doors to customers on January 17, 1947. It would likely have enjoyed continued growth had it not encountered the severe impact of catastrophic flooding in 2011, the only major setback so far to its decades-old business.

The floods led the company to grant a raft of insurance deals, causing it to bear huge operational and financial burdens as Bangkok was inundated with rain along with a swathe of provinces, seriously damaging businesses in many sectors.

“That was the first time our company went into the red,” Mr Chartchai recalled. “That has only happened once since we got established.”

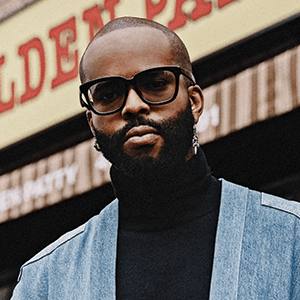

Chartchai Chinvetkitvanit

The company had to pay hundreds of millions of baht to stay afloat.

The loss occurred even though the company was well-prepared for anticipated risks. It believed it was in a strong position as it had a re-insurer, or a company that provides financial protection to insurance firms, as a back-up.

But it never imagined the insurer could have problems. This severely affected its plan to rely on financial protection from these firms.

He said the mistake taught the company two lessons: First, it needed to be more aware of its financial capabilities and limitations; second, it must never trust a single insurer, but rather make reinsurance deals with multiple companies.

Tag

Tag

Tag

Tag

Tag

Tag

SHARE THIS PAGE!