Family scion knows how to connect with Thai customers and he’s not afraid to reach out digitally

- By Chatchai Thanachindalert -

Founded in 1942 by Chao Phraya Sri Thammathibet, Thai Life Insurance Co serves as the first domestic entrant to this burgeoning industry.

In 1970, enterprising pioneer Vanich Chaiyawan bought the company and dramatically adjusted both its managerial and organisational structure. Since then, it has operated under the umbrella of the Chaiyawan family.

Second-generation scion Chai Chaiyawan now sits at the helm as the company’s president.

Mr Chai said that when his family took over the company, the life insurance business was very different to how it had been decades earlier.

He said his family felt under pressure to prove themselves as, at the time, the company was at the bottom of the industry as the public still did not trust a life insurance company run by Thais.

He said the firm and its sales agents worked hard to overcome many obstacles until such trust was established.

Since then it has adhered to a corporate spirit forged on the concept of “Thainess”, he said, adding it also conforms to international standards and has won a degree of global recognition.

“This was proved by our credit rating of AAA [the highest level] by Fitch Ratings, as well as the numerous business management awards we have collected from international organisations,” Chai said.

“What makes us different is that we never stop evolving,” he said, citing managerial restructuring, the continuous development of human resources, and the drive to keep adding new insurance policies tailored to customers’ changing needs.

In 2014, the company announced its vision of serving as a “people-centric business” by attaching equal importance to all stakeholders.

“We aren’t just selling life insurance policies but also our dedication, our willingness to serve and our loyalty,” he said. “These are more important than sales figures.”

Mr Chai said Thai Life Insurance wants to be perceived as a trustworthy friend by its customers; a friend who takes the time and effort to make sure you are well supported and your family will always be financially secure.

But doing this requires a profound understanding of what customers want, necessitating constant research and innovation so that the company can cover all angles, he said.

Risk management is also key to ensuring the business is sustainable, he said, as life insurance is a financial business.

Throughout its 76-year history the company has been fortunate to escape making even a single blunder in this area, Mr Chai said.

Yet he conceded that during the “Tom Yum Goong’’ crisis, or 1997 Asian financial meltdown, the company was forced to restructure and cut costs in order to survive.

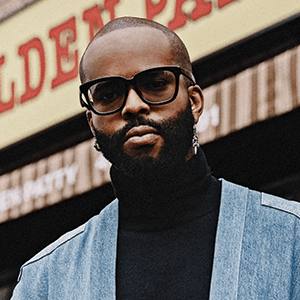

Chai Chaiyawan

Mr Chai said disruptive technology is proving a challenge for his business these days, much like many other companies, as the digital era ushers in profound change to consumer behaviour.

Meanwhile, competition is growing fiercer, forcing many operators including Thai Life Insurance to make dramatic adjustments in most areas of their business.

To cope with such challenges, the company has adopted a range of technologies to improve both its customer services and sales, he said.

Mr Chai said the company has launched a new “ecosystem strategy” to take advantage of the opportunities provided by the digital era by building stronger relations and greater interaction with its consumers and the Thai Life Insurance brand.

The company uses both conventional and digital platforms to reach out to consumers, he added.

Still, the ultimate key to success in the life insurance business is having a “human touch” he said, adding that is particularly important for sales reps, as they must first win over and gain the trust of customers. Technology is a supporting tool.

Tag

Tag

Tag

Tag

Tag

Tag

SHARE THIS PAGE!